VC IS BROKEN

UTOPIA…

Venture Capital was started to fund exciting tech businesses.

It was money seeking return competitively from others, fighting for the next big thing, being diversified, ensuring ecosystem growth, and included founders directly giving back.

ISSUES OBSERVED

group investor directions

so focused on USA

not value add

high fees (2+20)

offensive term sheets (liq pref, ratchets, restrictions)

deal sharing not deal hunter/fighter

focus on power law defines selection behaviour

not democratised

elitest

a “club”

strategy groupthink

no effort/return ($1 effort on PortCo same as $100m)

not founder friendly

difficult to access

sector and geo uberconcentrated

stats

why we win?

The Top 3 dominant factors of unicorn founders are:

1. No “plan B”

2. “A chip on the shoulder”

3. Unlimited self belief

70% of unicorn founders are underdogs (immigrants, women or minorities)

Only 53% had degrees from top 10 university

49% have STEM degrees

Not a single Fund has invested in over 3% of Unicorns!

Diverse founders create the winners - so crucial to find New Fund Managers who back these founders - Need GPs that also have perspective to pick non-consensus from the crowd

Nearly half of all LP capital raised in 2024 went to 5 funds!!! out of thousands

This has increased 2.5x from 2023 to 2024

Funds are concentrated but are not hitting all the time - need New Managers to find long tail opportunities

Unicorns used to have only male founders, but this is changing, with 17% having a female founder in 2023.

Only 34% of unicorn founders had worked at an elite employer prior to founding a unicorn, and

All-white, male, local, Ivy league archetype of founder is actually an infrequent occurrence, at 11%, and

only 33% of founders native to a country where they founded the company graduated from a top 10 university.

There’s only 30 funds that have more than 1% share of all these unicorns, which means that it’s totally fragmented and still provides opportunity for success on new approaches

problems

heard.

as founder…

How do I access if not "template founder"? - What can I do if not in the USA or UK or main geo? - Can I run normally as a CEO with framework metrics for the next round achievement ? - Growth plus ARR/MRR plus subs plus retention plus plus? - Metrics at each stage of seed/A/B/C/D?

as investor (lp) …

Where are the returns (DPI)? - Is there innovative in this industry (are they doing all they can)? - Are the exits the correct ones (not cross fund crystalisations, not badly priced IPOs (retail dump), not including fair trade sales or PE takeovers)? - Should we continue massive cash burn games with wrong incentives as a battle of attrition on “steroid supported” companies (do we figure the staff, economy and society impact)?

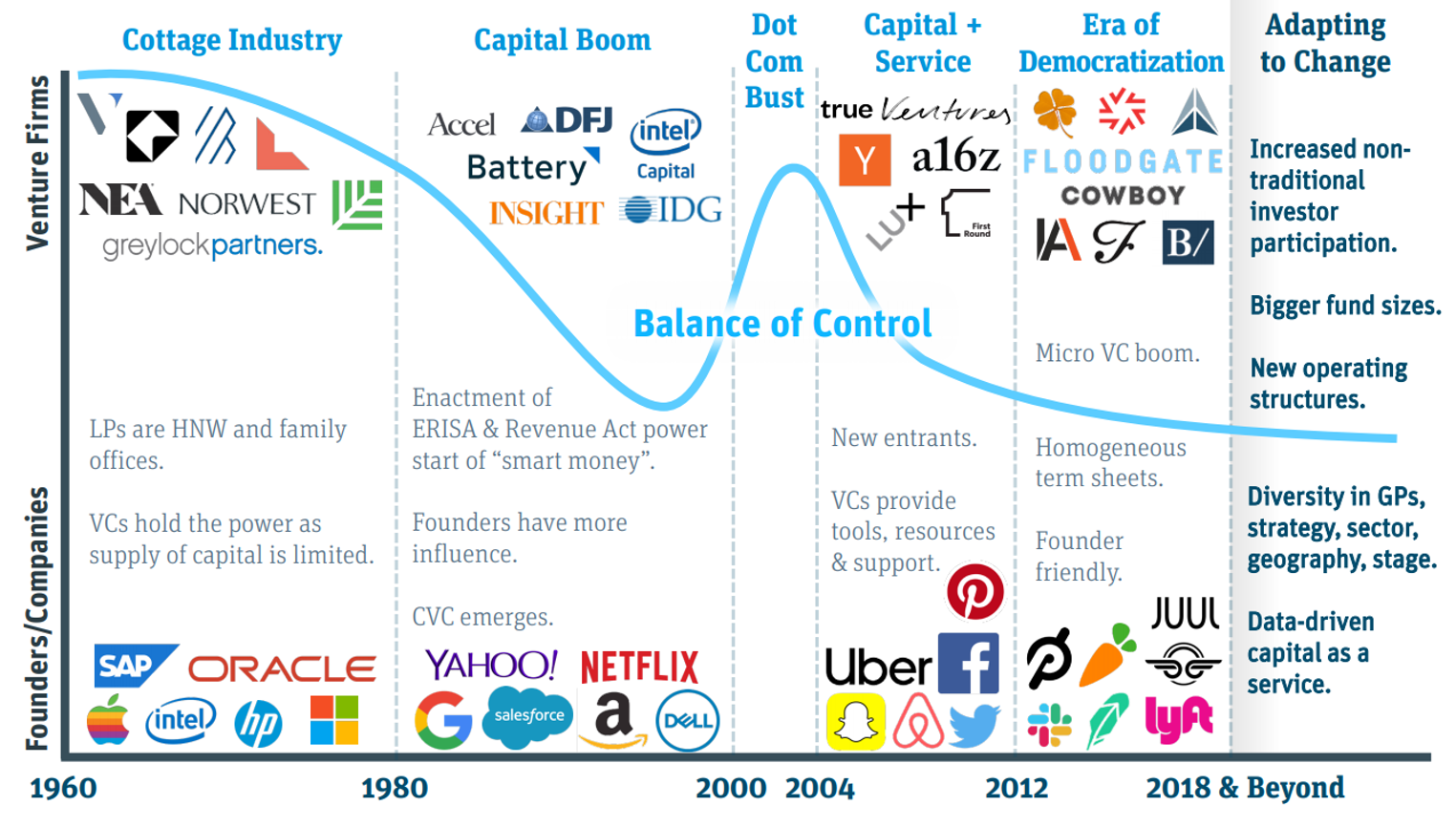

the history

First modern eg – ARDC (1946) investing in DEC -> 5000x return in 14 years

Capital pooling from FO and Insti into a “fund”, MIT, HBS and Fed background

Then infamous Fairchild SemiCon x Hayden Rock (VC 1950s) established the “20% in” rule, and then by 2014, an estimated 92 companies trace their roots back to them, includes Apple, Advanced Micro Devices, and Applied Materials, as well as venture firms like KPCB and Sequoia

The 1980s made the asset class and the 2000s brought the internet

deVC. contributed and run in tokens – directed anywhere

Stop the nonsense and find real winners

Let’s remove the bullshit and find excellent companies to invest in

Be proactive, not a copycat

Let’s hunter/fight – we won’t copycat or piggyback – must find/lead – not all deals are in the USA! (typ VC does 45% there)

Don’t let good ideas go to waste

Take the winners from the unfailed funnel (those will never got to start – how many potentials there?)

Focus on the right industries

Go after the rights place! (not food delivery …) fund would also chase certain ideas in certain thought spaces/key problem statements

Have ethical and global oversight

Governance committee - AI oversight, all ethics, key countries of target, key industries of target, key problem areas (Gates Foundation style)

Redesign the VC system for fairness

Min fees, strong returns, DECENTRALISE decisions, investment team, and the LP ownership – world first

OUR NEW WAY OF WORKING

deVC DETAILS

Dubai HQ - global team build out

3 tokens – GOV / GP / LP. Reg jursidication Offshore

Decentralise access for all users to invest

Token 1 - Governance token - for decisions where to invest. GOV will vote on the financial return targets based on industry norms - % of governance vote to pass

Governance also looks at the performance on fund mix parameters (concentration % etc)

Token 2 & 3 - Security tokens. These are FUND UNITs of two types - GP and LP

The LP will trade on dedicated exchange and it should theoretically trade upwards over time - from $1 to a potential discount to reported NAV at any given timepoint

The GP can be forced to change if certain criteria are not met. GOV vote can force a change and GP token must accept. Then new applications of GP would be due via a process

True focus on pre-seed and seed only .... can exit on secondaries but as part of primary uprounds